Earning passive income through cryptocurrency in Canada has become increasingly accessible in 2025, thanks to regulated exchanges and DeFi advancements. As an expert in crypto markets, I'll outline the best strategies tailored for Canadian users, focusing on platforms compliant with bodies like the Canadian Securities Administrators (CSA) and FINTRAC. These methods leverage staking, lending, and yield farming on exchanges such as NDAX, Coinbase, Kraken, and Binance (where available). Remember, crypto is taxable in Canada—rewards count as income, and capital gains apply on sales. Always consult a tax advisor.

We'll cover the top strategies with approximate yields (based on current 2025 market data, which can fluctuate), risks, and analytics. Yields are expressed as Annual Percentage Yield (APY), and I've included real-world examples from Canadian-friendly platforms.

1. Staking: Secure and Steady Rewards

Staking involves locking your crypto to support blockchain networks, earning rewards in return. It's one of the safest passive options, especially for Proof-of-Stake (PoS) coins like Ethereum and Cardano. In Canada, use CSA-registered exchanges like NDAX (up to 13% APY on ETH and ADA) or Kraken (2-11% on various assets).

An illustration of crypto staking rewards.

Approximate Yields (2025): 3-13% APY. For example, staking ETH on Coinbase might yield 4-6%, while Polygon (POL) offers up to 7%. Risks: Low to medium. Main risks include slashing (penalty for network downtime, rare on exchanges), lock-up periods (e.g., 7-28 days), and price volatility. No impermanent loss like in farming. Analytics: In 2025, total staked value in DeFi exceeds $200 billion globally, with Canada seeing growth due to regulatory clarity. Staking is ideal for long-term holders; diversify across 2-3 coins to mitigate volatility. Expected annual return on $10,000 staked ETH: $400-600.

2. Crypto Lending: Earn Interest on Holdings

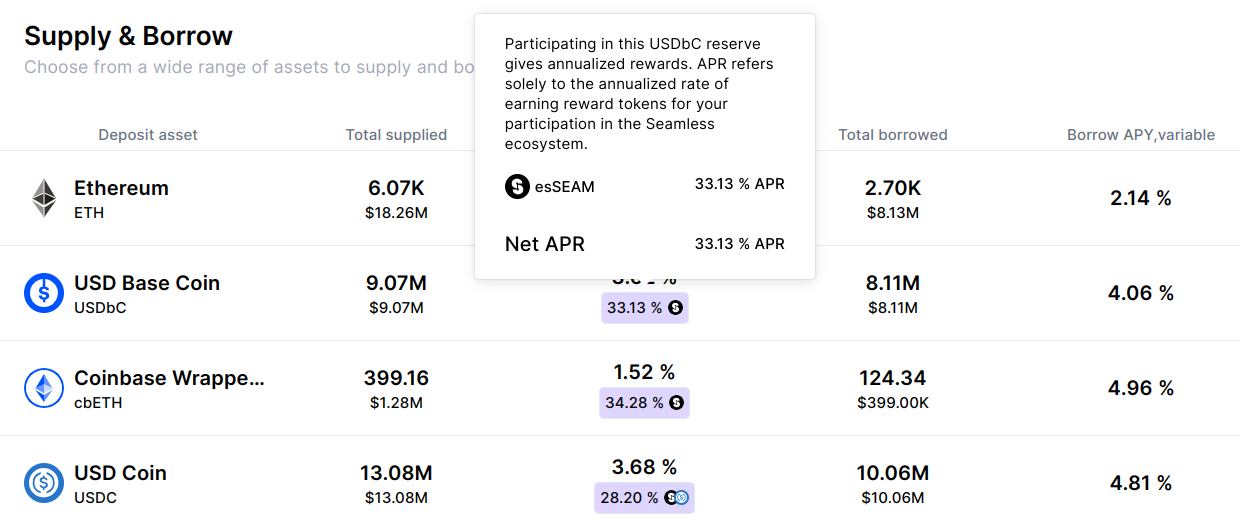

Lend your crypto to borrowers via platforms, earning interest similar to a savings account. Canadian options include Coinbase (rewards on stablecoins) and DeFi protocols like Aave (accessible via wallets). Rates fluctuate based on demand; stablecoins like USDC offer stability.

A screenshot of a crypto lending platform interface.

Approximate Yields (2025): 1-10% APY. Variable rates on Aave: 1-10% for USDC; fixed options around 4-6%. Tapbit offers up to 30% on select coins, but stick to regulated ones in Canada. Risks: Medium. Borrower default (mitigated by over-collateralization), platform hacks (use insured exchanges), and interest rate drops. In Canada, avoid unregistered platforms to comply with regulations. Analytics: DeFi lending TVL hit $200B+ in 2025, with stablecoin lending dominating for low-volatility income. For $10,000 in USDC lent at 5% APY, expect $500 annually. Combine with staking for hybrid strategies.

3. Yield Farming / Liquidity Provision: High-Reward DeFi

Provide liquidity to DEX pools (e.g., Uniswap) and earn fees plus tokens. Higher yields but more complex. In Canada, access via wallets connected to DeFi, or exchanges like VirgoCX for OTC support.

Infographic explaining yield farming mechanics.

Approximate Yields (2025): 10-30%+ APY, but variable. Uniswap pools: 5-20%; advanced farming on protocols like Compound: up to 30% with governance tokens. Risks: High. Impermanent loss (value divergence in pools), smart contract bugs, and high gas fees on Ethereum. Not ideal for beginners; use low-risk pools like stablecoin pairs. Analytics: Yield farming TVL grew 20% YoY in 2025, but 40% of farmers face impermanent loss. For $10,000 in a USDC/ETH pool at 15% APY, potential $1,500 return—but minus 5-10% loss risk.

Chart showing passive income yields across crypto assets.

Chart showing passive income yields across crypto assets.

Expert Tips for Canadians in 2025

- Start Small: Begin with $1,000-5,000 to test strategies. Use apps like Coinbase Earn for free crypto while learning.

- Diversify: Mix staking (low risk) with lending (medium) to balance portfolio. Avoid over-exposure to volatile altcoins.

- Regulatory Compliance: Stick to FINTRAC-registered exchanges like NDAX or Shakepay to avoid issues. Monitor CSA updates on DeFi.

- Tax Optimization: Track rewards with tools like Koinly; consider holding in TFSAs if via ETFs (crypto itself can't be held directly).

- Risk Management: Use hardware wallets for DeFi; enable 2FA; research APYs weekly as they change. In 2025, focus on sustainable yields over hype.

- Emerging Trends: Liquid staking (e.g., Lido) and restaking protocols offer compounded returns, but with added complexity.

In summary, passive crypto income in Canada can yield 5-20% annually with proper strategy, but always prioritize security and diversification. With market maturity in 2025, these methods are more reliable than ever—start with staking for beginners.