As an expert in cryptocurrency investments, I'll guide you through the top passive income strategies on crypto exchanges available to Canadians in 2025. With the market maturing and regulations tightening under the Canadian Securities Administrators (CSA), focus on compliant platforms like Coinbase, Kraken, Bitbuy, and Wealthsimple Crypto. Crypto is treated as a commodity by the Canada Revenue Agency (CRA), so earnings from staking or lending are often taxed as income (100% taxable) or capital gains (50% taxable at your marginal rate, which ranges from 15-33% federally plus provincial rates). Always track transactions for tax reporting by April 30, 2026, for the 2025 fiscal year. No new major laws in 2025, but emphasis on AML compliance and platform registration means sticking to authorized exchanges avoids restrictions.

Passive income here means minimal ongoing effort after initial setup, like holding or locking assets. Based on current data, average yields have stabilized post-2022 volatility, but risks like market crashes remain. I'll cover the best methods with approximate 2025 yields (based on historical trends and projections from sources like CoinLedger and Blockpit), risks, and analytics in a table for clarity. Yields can fluctuate; check real-time rates on platforms.

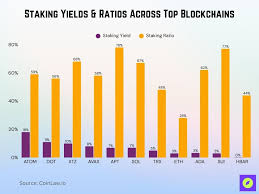

Staking Yields Across Top Blockchains (2025 Projections)

Key Strategies for Passive Income on Crypto Exchanges

1. Staking

Stake proof-of-stake (PoS) coins on exchanges like Binance (if CSA-approved) or Kraken to validate transactions and earn rewards. In Canada, use registered platforms to avoid issues. Popular assets: ETH, SOL, ADA.

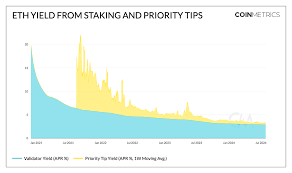

- Analytics: Staking ratios are high (e.g., ETH at 28-32% staked network-wide), leading to yields of 3-7% APY. Projections for 2025 show slight declines due to increased participation, but stablecoins like USDC can offer 4-6% via staking pools.

2. Crypto Lending

Lend assets on centralized (CeFi) platforms like Bitbuy/Cred or DeFi like Aave (via wallets connected to exchanges). Borrowers pay interest; you earn passively.

- Analytics: Platforms in Canada emphasize security post-FTX collapse. Yields for stablecoins: 4-8% APY; volatile assets like BTC: 1-5%. Bitbuy's partnership with Cred offers Bitcoin-backed loans, with Canadian users seeing average returns of 5% on BTC holdings.

Overview of Crypto Lending Markets on Platforms like Compound

3. Yield Farming/Liquidity Providing

Provide liquidity to DeFi pools on exchanges supporting DEX integrations (e.g., Uniswap via Coinbase Wallet). Earn fees and tokens.

- Analytics: High yields but volatile; 2025 projections: 10-30% APY on blue-chip pairs, down from 2021 peaks due to maturity. Impermanent loss can wipe out gains in bear markets.

Key Risks in Yield Farming: Impermanent Loss, Scams, and More

Key Risks in Yield Farming: Impermanent Loss, Scams, and More

4. Crypto Savings Accounts/Interest-Bearing Wallets

Use exchange savings products like those on Crypto.com or Gemini Earn (if available in Canada). Similar to bank savings but for crypto.

- Analytics: Regulated options yield 1-6% on stablecoins, safer than DeFi. Cloud mining via GBC Mining offers 5-10% but with energy cost risks.

5. Crypto ETFs/Index Funds

Buy and hold via Canadian brokers like Wealthsimple or Purpose Investments' BTC/ETH ETFs for passive exposure without direct management.

- Analytics: No active yields like staking, but dividends from underlying assets can provide 2-5% effective return via price appreciation. Low fees (0.4-1%).

Comparison Table: Strategies with Yields, Risks, and Expert Tips

| Strategy | Approx. 2025 Yield (APY) | Key Risks | Expert Tip for Canadians |

|---|---|---|---|

| Staking | 3-8% (e.g., ETH: 3-5%, SOL: 6-8%) | Market volatility, slashing penalties (loss of staked amount for downtime), lock-up periods (21-28 days for ETH). Taxed as income. | Use CSA-registered exchanges like Kraken; diversify across assets to mitigate volatility. Projections show ETH yields stabilizing at 4% with network upgrades. |

| Lending | 2-10% (stablecoins: 4-8%, BTC: 1-5%) | Platform insolvency (e.g., post-2022 collapses), borrower default, interest rate fluctuations. No CDIC protection. | Opt for over-collateralized loans on Bitbuy; monitor LTV ratios. In 2025, expect tighter regs reducing risks but capping yields. |

| Yield Farming | 5-30% (high for new pools, 10-20% avg.) | Impermanent loss (up to 50% in volatile pairs), smart contract hacks, rug pulls/scams. High gas fees on ETH. | Start small on audited DeFi like Aave; avoid unvetted pools. 2025 trend: Safer yields via layer-2 solutions like Arbitrum. |

| Savings Accounts | 1-6% (stablecoins dominant) | Low liquidity during market stress, exchange hacks. Taxed as interest income. | Use Wealthsimple for simplicity; combine with TFSAs if possible (though crypto not directly eligible). Steady option for beginners. |

| ETFs/Index Funds | 2-5% effective (via appreciation/dividends) | Market downturns (e.g., 2022 bear market -70%), no direct yields. Management fees. | Hold in RRSPs for tax deferral; Purpose BTC ETF has seen 3% avg. annual yield from holdings. Ideal for long-term passive. |

| Cloud Mining | 4-12% (depending on contract) | Scams, energy price hikes, low profitability in bear markets. Environmental regs in Quebec limit large ops. | Choose reputable providers like GBC; calculate ROI with BTC at $80K+. Risk-adjusted returns better than AI bots per recent studies. |

Yields are estimates based on mid-2025 projections; actuals depend on market conditions (e.g., bull run could boost to 15%+ for farming). Risks are moderate-high overall—diversify to under 10% portfolio per strategy. Analytics show DeFi TVL at $100B+, but Canadian adoption lags at 5-10% of users due to regs.

ETH Staking Yield Trends Over Time

Final Expert Advice

Start with $1,000-5,000 in stable assets on a regulated exchange to test waters. Monitor via tools like CoinMarketCap for yields. In 2025, with potential rate cuts, yields may rise slightly, but prioritize security—use hardware wallets and enable 2FA. Consult a tax advisor for CRA compliance, as staking rewards must be reported at FMV. This isn't financial advice; DYOR and consider volatility (crypto down 20%+ in corrections). For more, check CSA-authorized lists.