As an expert in cryptocurrency investments with a focus on regulated markets like Canada, I'll share practical advice on generating passive income through crypto exchanges and platforms. In 2025, Canada's crypto landscape is more mature, with clear CRA tax guidelines treating staking and lending rewards as income, and regulations allowing staking while limiting high-risk lending. Platforms like Wealthsimple Crypto, Bitbuy, NDAX, and international ones compliant with Canadian rules (e.g., Kraken, Coinbase) are ideal for starting. Always prioritize security, diversify, and consult a tax advisor—rewards are taxable upon receipt.

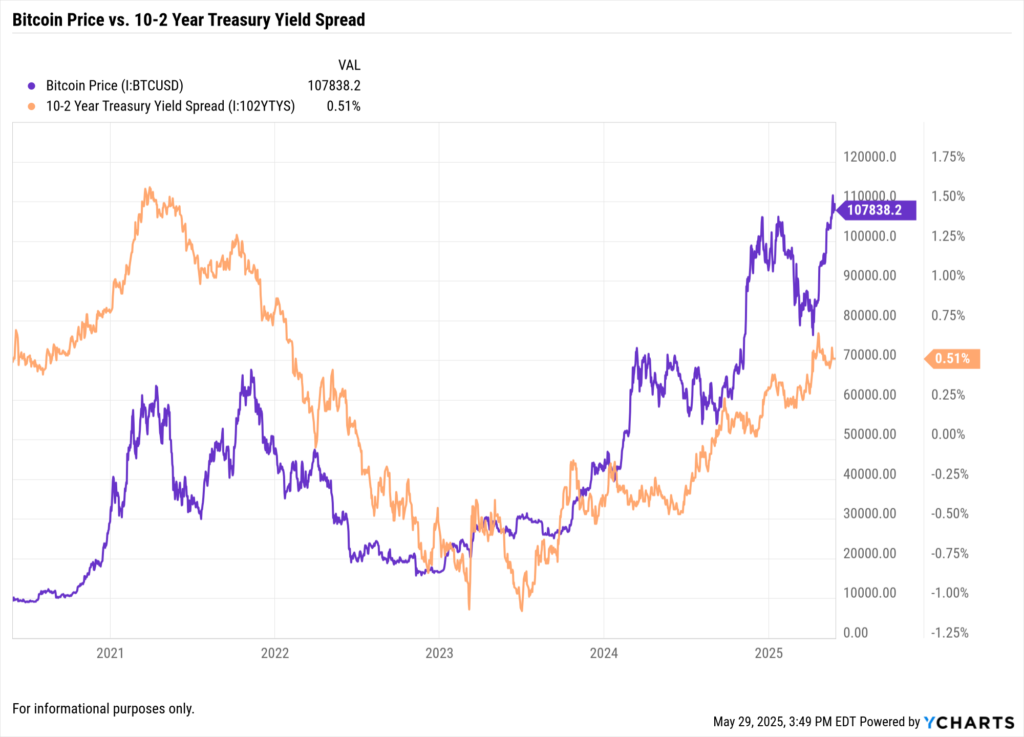

Key analytics: The total value locked (TVL) in DeFi has surpassed $200 billion globally in 2025, with Canada seeing increased adoption via ETFs like the new Solana staking ETFs. However, volatility remains high; Bitcoin's price correlation with treasury yields (as shown below) influences overall market stability, potentially affecting passive yields during economic shifts.

Crypto market influenced by treasury yield spreads in 2025 (Source: YCharts)

Below, I'll outline the best passive income strategies tailored for Canadians, with approximate 2025 yields based on current data (these fluctuate; check real-time rates), risks, and tips. I've used a table for clear comparison.

| Strategy | Description | Approx. Yield (2025) | Risks | Platforms for Canadians | Expert Tip |

|---|---|---|---|---|---|

| Staking | Lock crypto to validate blockchain transactions and earn rewards. Compliant in Canada; rewards taxed as income. | 5-20% APY (e.g., Ethereum ~5-7%, Solana ~6-8%) | Market volatility, slashing (penalties for downtime), lock-up periods. Low-moderate risk. | Kraken, Coinbase, or Canadian Solana ETFs (launching April 2025 for passive staking income). | Start with stable PoS coins like ETH; use non-custodial wallets for control. Diversify to avoid network-specific issues. |

| Lending | Lend crypto to borrowers via platforms for interest. Limited in Canada due to regulations on illiquid assets. | 2-10% APY (stablecoins like USDC ~4-7%; higher for volatile assets) | Counterparty default, platform insolvency, regulatory changes. Moderate risk. | Aave (DeFi), Ledn (Canadian-based), or Compound. Avoid unrestricted CeFi like pre-2023 Binance. | Lend stablecoins to minimize volatility; monitor CRA rules—interest is income. |

| Yield Farming | Provide liquidity to DeFi pools for rewards in tokens or fees. Taxed on receipt; growing in Canada with safer protocols. | 20-50%+ APR (but variable; e.g., automated farms ~30-50%) | Impermanent loss (price divergence), smart contract hacks, high gas fees. High risk. | Uniswap, PancakeSwap via MetaMask; Yearn Finance for automation. | Use yield aggregators to optimize; start small (e.g., $1,000) and hedge with stablecoin pairs. |

| Liquidity Providing | Add assets to exchange pools to facilitate trades and earn fees. Similar to farming but focused on trading volume. | 5-30% APY (depending on pool activity; e.g., ETH/USDC pairs ~10-20%) | Impermanent loss, liquidity crunches during volatility. Moderate-high risk. | DEXs like Uniswap or SushiSwap; integrated on Canadian apps like Wealthsimple. | Focus on high-volume pairs; withdraw during bear markets to avoid losses. |

| Cloud Mining | Rent mining power for Bitcoin rewards without hardware. Banned for new projects in BC, but existing ops okay elsewhere. | 5-15% APY (post-halving adjustments in 2025) | Energy costs, regulatory bans (e.g., BC), scam platforms. Moderate risk. | Hashing24, NiceHash (check Canadian compliance). | Opt for reputable providers; calculate ROI with Bitcoin's ~$80K price in 2025 analytics. |

Staking remains the safest entry point for Canadians, especially with the 2025 Solana ETF launch allowing passive rewards in RRSPs. Yields have stabilized post-2024 volatility, but expect dips if interest rates rise—diversify 50-70% in staking, 20-30% in DeFi for balance.

.png)

Popular crypto lending platforms

For lending, platforms like Ledn offer proof-of-reserves, aligning with Canadian transparency rules. Analytics show average stablecoin yields at 4-7%, but risks spiked in 2022 collapses—stick to overcollateralized loans.

Yield farming in DeFi visualized

Yield farming can supercharge returns, but impermanent loss hit 20-30% in volatile 2024 pools. In 2025, AI-driven tools on platforms like Yearn reduce this—aim for 30% APR on diversified farms, but cap exposure at 20% of portfolio.

Key factors in choosing crypto liquidity providers

Liquidity providing thrives on high-volume exchanges; Canadian users benefit from low-fee DEXs. Risks include flash crashes, but 2025's institutional inflows (e.g., via ETFs) boost stability.

Overall analytics: Passive crypto income in Canada could yield 10-25% annually diversified, outperforming traditional savings (~2-4%), but with 20-50% volatility risk. Start with $500-1,000, use hardware wallets, and track via tools like Koinly for taxes. If rates fall globally, expect higher DeFi yields—monitor via CoinMarketCap or DeFiLlama.